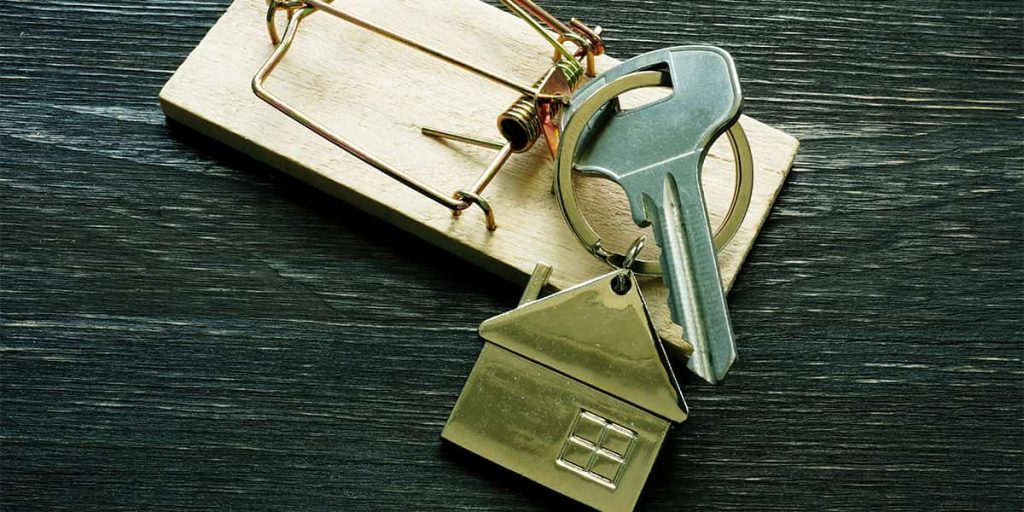

5 Common Real Estate Scams And How To Catch Them Early

Investing in your first home or a commercial real estate investment deal should be an exciting, happy moment where you’ve just spent money in the hopes of making more down the line. Sadly, those hopes can sour overnight and the property you think you now own might have never been yours to buy in the first place. Real estate scams can be some of the most financially devastating events in your life should you be ensnared in one.

The FBI’s Internet Crime report 2021 reported that losses from real estate cybercrime had increased by 64% from $213.2 million to $350.33 million between 2020 and 2021. Digital real estate investment scams were exacerbated by the pandemic, forcing most real estate transactions to move online. Open houses and negotiations over coffee were moved to 3D virtual tours and negotiations over Zoom calls. Due to this shift towards more online, virtual real estate investments, it was easier for hackers to impersonate sellers or steal personal information and defraud investors of their money.

As the potential sum of money on the line can be significant, you must stay aware of the dangers of real estate scams. Below are some of the most common real estate scams and the red flags to look out for.

The Most Common Real Estate Investment Scams

-

Rental Scams

Rental scams occur when a scammer posts a fraudulent listing online, offering a property they do not own for rent. It’s usually made attractive by offering below-market prices and beautiful property pictures. They then claim that an upfront deposit is needed to tour the property or that the homeowner is away and unable to show the property. Still, with a deposit, the property can be made available for the renter to view. Once any money has been transferred, the renter never hears from the “landlord” again.

Unfortunately, as reported by Apartment List this type of fraud is very common. Around 43.1% of renters have viewed listings that they suspected to be fraudulent, and 5.2 million U.S. renters have lost money from rental fraud.

-

Foreclosure Scams

Particularly saddening is the scam linked to foreclosures. Scammers identify homeowners who are facing foreclosure and make them promises of saving their home by negotiating with the bank, potentially reducing the mortgage fees significantly but for a large upfront fee. Desperate homeowners may agree to the scammer’s terms and make an upfront payment, only for the scammer to disappear without ever negotiating with the bank.

-

Loan Scams

This occurs when predatory ‘residential or commercial’ real estate lenders convince a homeowner to refinance their mortgage multiple times, each time usually borrowing more. The scammers charge high fees and points for each transaction. The homeowner is then stuck making high-interest loan payments they can’t afford after being tricked into borrowing most of the home’s equity.

Get In Touch With The Real Estate Investor News Team If You Want To Know More About Buying And Financing Investment Properties

-

Title Fraud

In this case, the scammers create fraudulent documents to transfer ownership of a property to themselves. They then proceed to take out real estate loans against the property’s equity before disappearing with the money.

-

Moving Scams

These scammers operate under the guise of a legitimate moving company. They initially provide a relatively low price for packing and moving your goods to a new home. However, once the items have been loaded onto the truck, the scammers then hold your personal items hostage while trying to claim a higher moving fee. Or otherwise, they may not even show up after taking the deposit.

The above 5 are the most common types of scams you may find in the market. Now, let’s take a look at red flags that can warn you that the deal is too good to be true.

Real Estate Scams Red Flags

-

Rushed Sale

If the seller is advertising their property at below-market prices and is pushing to make the sale happen immediately, there is something wrong with the picture. Always take your time to scrutinize the property, the offer, and the seller. If they refuse to give you an appropriate amount of time to do your due diligence, do not be tempted to close the deal for fear of missing out.

-

Promises of Unrealistic Returns

Some builders convince real estate investors by painting a picture for them of how much rent the investor can make by making a purchase. Always do your own research on the real estate market, as you may find it difficult or impossible to find tenants for the property, even at reduced rental rates.

-

Almost Any Type Of Upfront Fees

While an upfront fee may be required for certain transactions, it is extremely important to validate the deal before transferring any money to the seller. They may even offer to sell your property for you unsolicited and charge you a down payment to represent your property. This is often paired with a “money-back guarantee” if the property isn’t sold. They then disappear after receiving the initial payment. Always try to meet the sellers in person when making payments.

-

They Ask For Your Personal Information

Scammers may try to go phishing for your personal or financial information, so be extremely wary about who is on the other end of the line. Avoid giving out your personal and financial information as a practice, and when you must, vet the sellers with care to avoid falling for identity theft.

Conclusion

Above are just some of the most common real estate scams that could befall you should you not be vigilant. Should you have a legitimate real estate deal that you are sure is not fraudulent, you may be looking for reliable, affordable lenders to help close the deal. Well, that’s what we specialize in at REI News, with our teams of professionals matching investors with trusted residential and commercial real estate lenders to help them achieve their real estate goals. Get in touch today to find out how to secure financing options for your next deal.

Let Us Help You Boost Your Real Estate Projects!

Share your real estate investment projects with us and one of our team members will contact you with the right funding solution.

Previous Post

Previous Post Next Post

Next Post