With The Housing Market Down, What Does 2023 Look Like For Mortgages?

We’ve covered mortgages quite a bit on this site, especially the mortgage rates over the last few months and how they have changed to reflect the Fed’s attempts at combating inflation through rate hikes. The high mortgage rates for investment properties are reflected in the housing market, where total housing inventory is up 980,000 units, up 2.1% from December. However, low inventory has been an issue since the 2008 housing crash, and it will likely remain low even as it improves in 2023.

With sales numbers slowing and inventory rising, we should start seeing a slowdown in price increases. Those holding onto property as long-term investments may want to consider whether a sale in a few months makes financial sense. National Association of Realtors Chief Economist Lawrence Yun commented, “ Home sales are bottoming out.” Existing home sales have fallen consistently, down 6.34 million since January 2022.

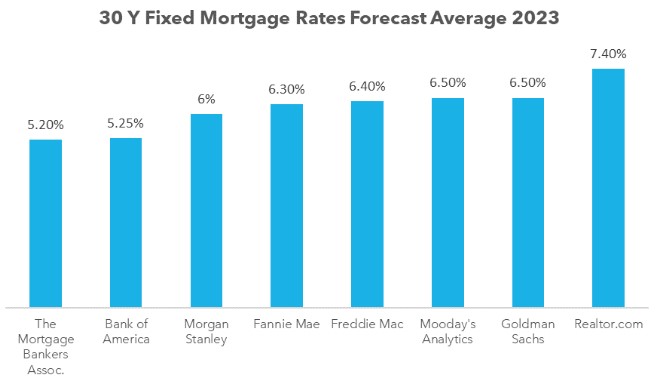

So are we heading toward a crash in the market? While market prices will likely continue to grow in the next few weeks), peaking around June. Prices will unlikely crash as inflation starts to come under control. As one of the key drivers of home purchases will be mortgage rates, Fortune collated forecast data from eight trusted mortgage research and news sources to see where experts believe the average mortgage rate will settle in 2023.

As evidenced, most experts don’t believe buyers should expect significant drops in mortgage rates as the average rate falls in and around the mid to low 6%. If these forecasts pan out accurately, you’ll most likely be able to enjoy the lowest rates towards the end of the year after inflation has stabilized. However, note that during a period of inflation, predictions can turn out to be wildly inaccurate, so take the above forecasts with a pinch of salt.

Many are basing this prediction on the notion that the results of the Fed’s increased rates will start to dampen inflation, in which case the rates will drop. Additionally, with a lack of demand in the housing market and for real estate funding, lenders and homeowners may have to reduce rates.

Get In Touch With The Real Estate Investor News Team If You Want To Know More About Buying And Financing Investment Properties

What does this all mean?

With sales dropping (hopefully bottoming) and inventory gradually rising, prices should start to level out towards the mid of 2023. buyers may want to start shopping around for a deal. Just maybe not immediately – with all signs pointing to mortgage rates climbing towards 7%, wait a bit for them to start dropping with the caveat that inflation slows down.

If you find a great deal in the down market and are ready to invest in property but need some financing to bridge the gap in your budget, talk to the REI News team. We specialize in pairing investors with affordable, credible lenders so get in touch now.

Let Us Help You Boost Your Real Estate Projects!

Share your real estate investment projects with us and one of our team members will contact you with the right funding solution.

Previous Post

Previous Post Next Post

Next Post